As it is largely independent of States, currencies, productivity or creditworthiness, gold offers investors a high degree of security, especially in economically and politically difficult times.

You need no knowledge of the stock market to invest in gold, nor do you have to pay attention to share prices on a daily basis. Gold bullion coins and gold bars are an uncomplicated form of long-term investment and are easy to acquire from Münze Österreich, banks and coin dealers. And gold has always been popular and sought-after.

As it is largely independent of States, currencies, productivity or creditworthiness, gold offers investors a high degree of security, especially in economically and politically difficult times. Gold is a very good hedge against many risks, both known and unknown. The price of gold can of course fall, but gold retains its purchasing power in the long term.

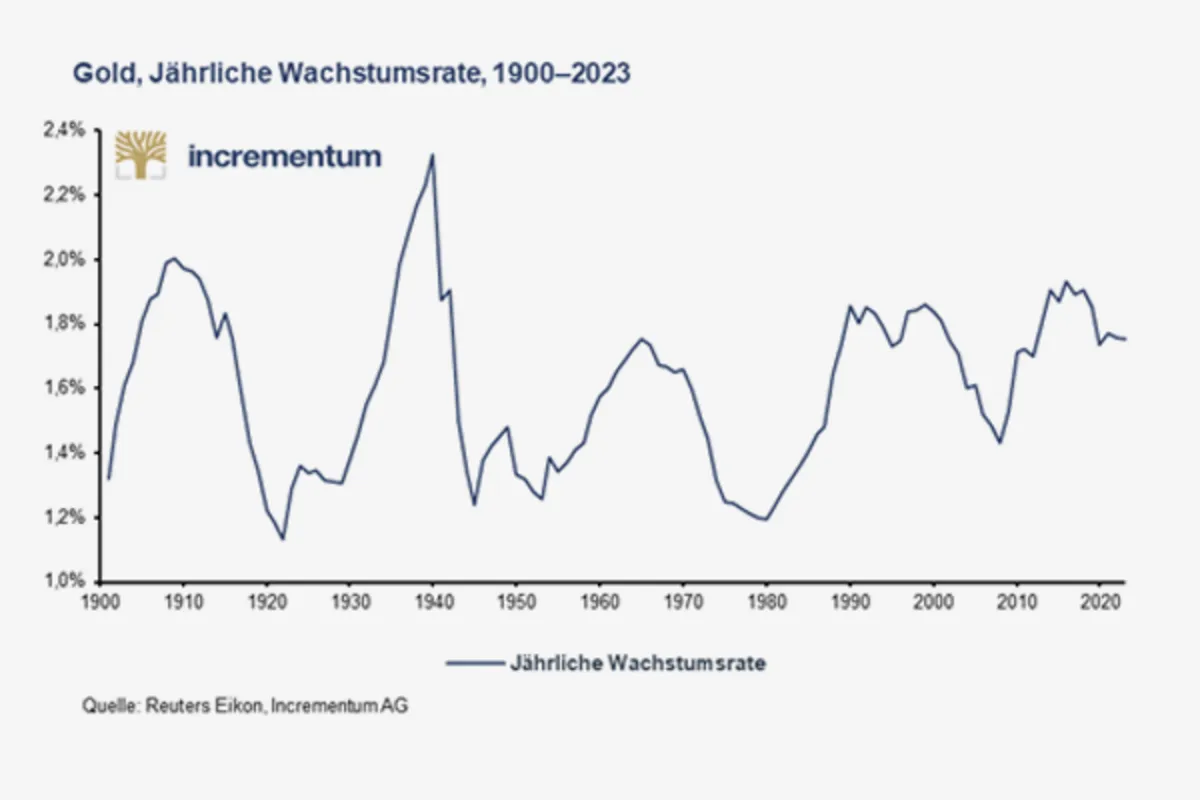

Gold has proved that it is a stable investment over long periods of time. One ounce of gold still buys roughly the same amount of oil as it did in 1947, for example, even though the price of oil has increased around thirtyfold since then. One of the reasons for this is that gold owners can be sure that the existing total quantity of gold will remain relatively constant because annual production of new gold is relatively low in relation to the existing amount. Currently, around 1.7 per cent of new gold is added annually to the total amount of gold mined to date. In other words, it would take almost 60 years for the current amount of gold in existence to double.

In view of its deep cultural roots in many societies, gold will be able to maintain its purchasing power and status as a liquid reserve asset over longer periods of time in the future. Gold is therefore particularly suitable as a long-term investment and should not be evaluated in the short term and traded speculatively.

Like gold, silver is also a very scarce precious metal and represents an interesting alternative for investors. This is primarily due to the significantly lower price of silver. But unlike gold, silver is actually consumed and has far more industrial uses than gold. Since the thermal and electrical conductivity of silver is better than that of gold, silver is one of the major beneficiaries of the renewable energy transition, in particular the sharp increase in demand for solar panels. Silver is also in high demand from the jewellery industry. According to experts, all this makes the value of silver just as stable as that of gold in the long term.

Highly valued as one of the rarest precious metals, platinum is the precious metal of choice in the manufacture of the finest jewellery. Although it is also sought after by investors in the form of coins and bars, platinum is primarily used in industry due to its special physical and catalytic properties. Demand for platinum is also a beneficiary of the green transformation of the economy.

Gold, silver and platinum make suitable investments for everyone and there are many ways to invest in them. Münze Österreich’s product range even offers interesting investment opportunities for people with small budgets to invest in a bright future.

Platinum is valued as one of the rarest of precious metals. It is best known for being the premier choice for the finest jewellery.

Whether the gold price is currently low or high depends on the expectation of whether it will rise in the future.