Whether the gold price is currently low or high depends on the expectation of whether it will rise in the future.

For an investor, the key question is how the price of their investment will develop. Investors purchase an asset not because they particularly like it, but in the hope that they can sell it later at a profit. Whether the gold price is currently low or high depends on the expectation of whether it will rise in the future. Additionally, for investors, it is important to compare gold with other investment instruments such as stocks and shares, bonds or real estate, taking into account the relative risk of each investment.

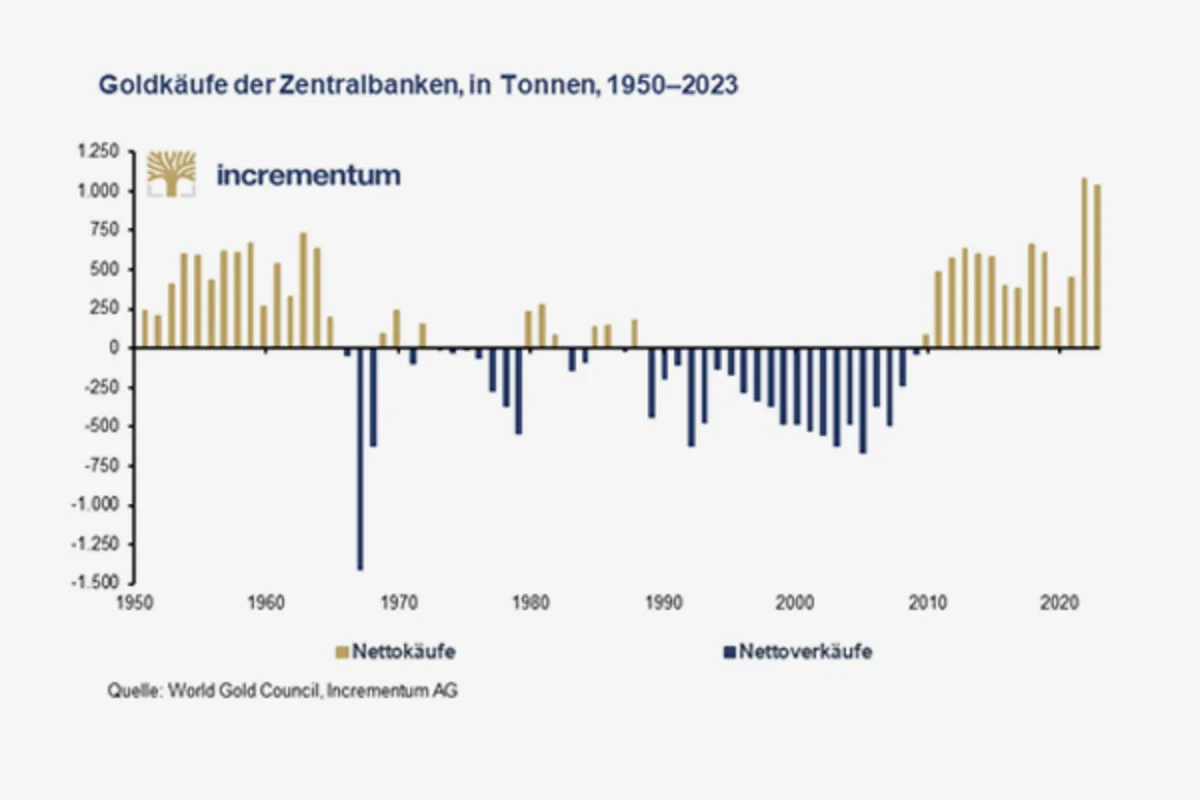

The gold market is currently undergoing a fundamental shift. On the one hand, Asia is becoming increasingly important for gold demand, while the West is losing influence. On the other hand, since the outbreak of war between Russia and Ukraine in February 2022, central banks have significantly increased their gold demand.

The sanctioning of Russian currency reserves as an immediate response by the West to the outbreak of war between Russia and Ukraine marked a turning point in the gold market. Overnight, gold was significantly revalued as a neutral asset without counterparty risk. In particular, Asian central banks, led by the Central Bank of China, have significantly increased their demand for gold. From 2010 to the outbreak of the Russia-Ukraine war in the first quarter of 2022, average quarterly gold purchases were 117 tons. In the first seven quarters after the outbreak of the war, this more than doubled to 291 tons per quarter. This increased the share of central banks in total gold demand from around 10 to nearly 25 per cent. According to a survey published in June 2024, most central banks expected to further increase their gold reserves in response to intensifying geopolitical tensions.

Non-Western countries and regions also dominate other segments of gold demand, and significantly so. In 2023, global demand for gold jewellery reached a total of 2,092 tons, with some 630 tons sold in China, 562 tons in India and 171 tons in the Middle East. Combined, this represents nearly two-thirds of global jewellery demand. Demand for gold bars and coins in 2023 was also highest in China (279 tons), India (185 tons) and the Middle East (114 tons), which together accounted for nearly half of the global total of 1,189 tons.

With growing economies and populations, India and the Gulf States have a particularly strong affinity for gold. China’s economic growth has slowed somewhat but is still significantly higher than in Western industrialized nations. Demand for gold in non-Western countries is therefore expected to remain high.

Compared with productive assets such as stocks and shares, gold is currently relatively inexpensive. The ratio between the Dow Jones Index and gold expresses how many ounces of gold are needed to buy one unit of the entire Dow Jones Industrial Index. With the Dow Jones Index currently (06/2024) standing at just over 39,000 and the gold price per ounce at just over USD 2,300, the ratio is 17.0. This means that 17 ounces of gold are needed to buy one unit of the Dow Jones Index, which consists of 30 individual stocks.

Historically, gold has been overvalued relative to the Dow Jones Index when the ratio has fallen below 5. The last time this occurred was during the crash of October 1987, when the ratio dropped to around 3.5. Subsequently, the Dow Jones Index and the gold price developed in opposite directions. While the gold market continued its long-term bear trend in the following years, the Dow Jones Index rose rapidly. The ratio eventually reached an all-time high of over 40 in August 1999.

Twice in the past century, the ratio reached around 1 during periods of extreme financial market turmoil. The most recent instance was at the end of the stagflationary 1970s, when the Dow Jones was around 900 points and an ounce of gold cost USD 850. Similarly, after the great stock market crash of 1929, there was parity between gold and the Dow Jones Index. Since the collapse of the Bretton Woods system in 1971, the average has been 13.5, below the current level (06/2024). Thus, gold is slightly undervalued compared with stocks.

Meanwhile, the US dollar has drastically lost value against both the Dow Jones Index and gold. After all, a rise in the stock index simply means that more US dollars are needed to purchase a share in a company.

Since 1989 Münze Österreich has been producing the Vienna Philharmonic, Europe’s only bullion coin.