Since 1989 Münze Österreich has been producing the Vienna Philharmonic, Europe’s only bullion coin.

The Vienna Philharmonic in gold went on sale for the first time on 10 October 1989. The bullion coin quickly captured the international gold market, which is traditionally dominated by countries with their own gold-mining operations such as China, Australia, Canada and the United States. With the highest possible purity of 99.99 per cent, around 13.8 million of the 1 ounce coins had been sold worldwide by the end of 2023, with the coin being recognised as the world’s best-selling bullion coin on numerous occasions. The popularity of the Vienna Philharmonic has also made Austria a gold-loving country.

The Vienna Philharmonic in gold is available in 1 ounce, 1/2 ounce, 1/4 ounce, 1/10 ounce and 1/25 ounce. Each coin’s sales price is based on the material value of the gold it contains. When purchasing from Münze Österreich, the gold price is updated every second, so you always receive the current price. The Vienna Philharmonic in gold is also legal tender, with a face value ranging from 100 euros (1 ounce) to 4 euros (1/25 ounce), although the material value of the coin is far higher.

The complex design of the coin in combination with its shiny surfaces and fluted edge guarantees the authenticity of the Vienna Philharmonic in gold and facilitates its sale worldwide. Due to its global acceptance, the Vienna Philharmonic in gold is not only a secure, globally recognised investment option but also an extremely liquid one.

| Face Value | Gold Weight | Fineness | Diameter | |

|---|---|---|---|---|

| 1 Ounce | 100 Euro | 31.10 g | 999.9 Au | 37 mm |

| 1/2 Ounce | 50 Euro | 15.55 g | 999.9 Au | 28 mm |

| 1/4 Ounce | 25 Euro | 7.78 g | 999.9 Au | 22 mm |

| 1/10 Ounce | 10 Euro | 3.11 g | 999.9 Au | 16 mm |

| 1/25 Ounce | 4 Euro | 1.24 g | 999.9 Au | 13 mm |

Gold has exerted a special fascination for thousands of years. It has long been used as a means of payment and is still used as a hedge in times of crisis by central banks and private individuals alike. Thanks to its unique properties, gold is also in constant demand from industry. This versatility guarantees that gold will always retain its value.

An investment in gold enables geographical diversification of one’s portfolio, as the worldwide demand for gold is spread across the entire globe. Demand is particularly high in the Gulf region, India, China, Russia, Australia, Canada, the United States, Turkey and Germany.

The demand for gold is increasingly shifting from the West to East due to the economic growth and young population of the latter, which offers investors opportunities for higher returns. Gold is also attractive from a tax perspective as no VAT is paid on the purchase and its sale is tax-free from one year after purchase.

Platinum is a fascinating metal that is unique in many ways and plays an important role in various industries and the investment sector. Since 2016, the Vienna Philharmonic in platinum has complemented the famous range of Vienna Philharmonic coins in gold and silver.

The platinum Philharmonic is available as a 1 ounce coin with a face value of 100 euro, and as a 1/25-ounce coin with a face value of 4 euro, both with a high degree of fineness: 999.5. As with all bullion coins, the platinum coins’ material value – and therefore the purchase and sale price – considerably exceeds the face value.

| Face Value | Platinum Weight | Fineness | Diameter | |

|---|---|---|---|---|

| 1 Ounce | 100 Euro | 31.10 g | 999.5 Pt | 37 mm |

| 1/25 Ounce | 4 Euro | 1.24 g | 999.5 Pt | 13 mm |

Rarity and Availability of Platinum

With an annual production of just 180 tons in 2023, platinum is significantly rarer than gold and silver. Production of the precious metal is heavily concentrated in South Africa, which accounts for around 70 per cent of new global production. Other important platinum-producing countries are Russia, Zimbabwe and Canada.

The Gold-to-Platinum Ratio: a Comparison

Platinum is one of the rarest precious metals in the world. Its limited availability and the high cost of mining the metal contribute to its price. A key figure that expresses the ratio of the price of gold to the price of platinum, the gold-to-platinum ratio indicates how many ounces of platinum equal the price of one ounce of gold. Historically, platinum was often valued higher than gold due to its rarity and use in industrial applications. In the past, the gold-to-platinum ratio was therefore often less than 1, which meant that platinum was more expensive than gold. In recent years, however, this ratio has shifted. Since around 2015, the gold-platinum ratio has often been above 1, which means that the price of platinum is more favourable than the price of gold.

Market Development and Future Prospects

The future development of the platinum market depends heavily on the further development of technologies that rely on platinum, particularly in the automotive industry and the hydrogen economy. While short-term fluctuations in the price of platinum can be influenced by economic and political events, long-term trends towards sustainable technologies and the limited availability of platinum may lead to price increases.

Industrial Use of Platinum

On the demand side, the automotive industry continues to play a dominant role, particularly through the use of platinum in catalytic converters. Platinum is also indispensable in medical technology; for example in implants and pacemakers. The metal is also of crucial importance for hydrogen technology, where it is used as a catalyst in fuel cells. With the increased use of hydrogen in the context of the energy and transport transition, demand for platinum is likely to increase significantly.

Importance of Platinum in the Jewellery Industry

Another important demand segment is the jewellery industry, where platinum is highly valued due to its scarcity and precious appearance. Demand for platinum jewellery is particularly high in China, Japan and the United States, which has a significant impact on the price of platinum.

In 2008, the Vienna Philharmonic in gold was given a little sibling – the Vienna Philharmonic in silver. This coin is offered in a denomination of 1 ounce with a fineness of 999. The face value is 1.5 euros and, as with all bullion coins, the material value is far higher than the face value of the coin.

Silver coins have been used as a means of payment for many centuries. The name ‘dollar’, for example, is derived from the Joachimstaler, a silver coin minted in the early 16th century, and numerous silver coins were issued in the following centuries. The Maria Theresa Taler, which was first minted in 1741 and was the official currency in Austria until 1858, is still in circulation in parts of Africa today.

The difference between the purchase and sale price of silver bullion coins is significantly greater than that of gold coins because, unlike gold, silver is not exempt from VAT. In addition, fixed costs for minting, transport and storage lead to a higher premium for silver coins in relation to the value of the material. The price of silver is also subject to greater fluctuations than the price of gold.

| Face Value | Silver Weight | Fineness | Diameter | |

|---|---|---|---|---|

| 1 Ounce | 1.50 Euro | 31.07 g | 999 Ag | 37 mm |

Silber-Gold-Ratio

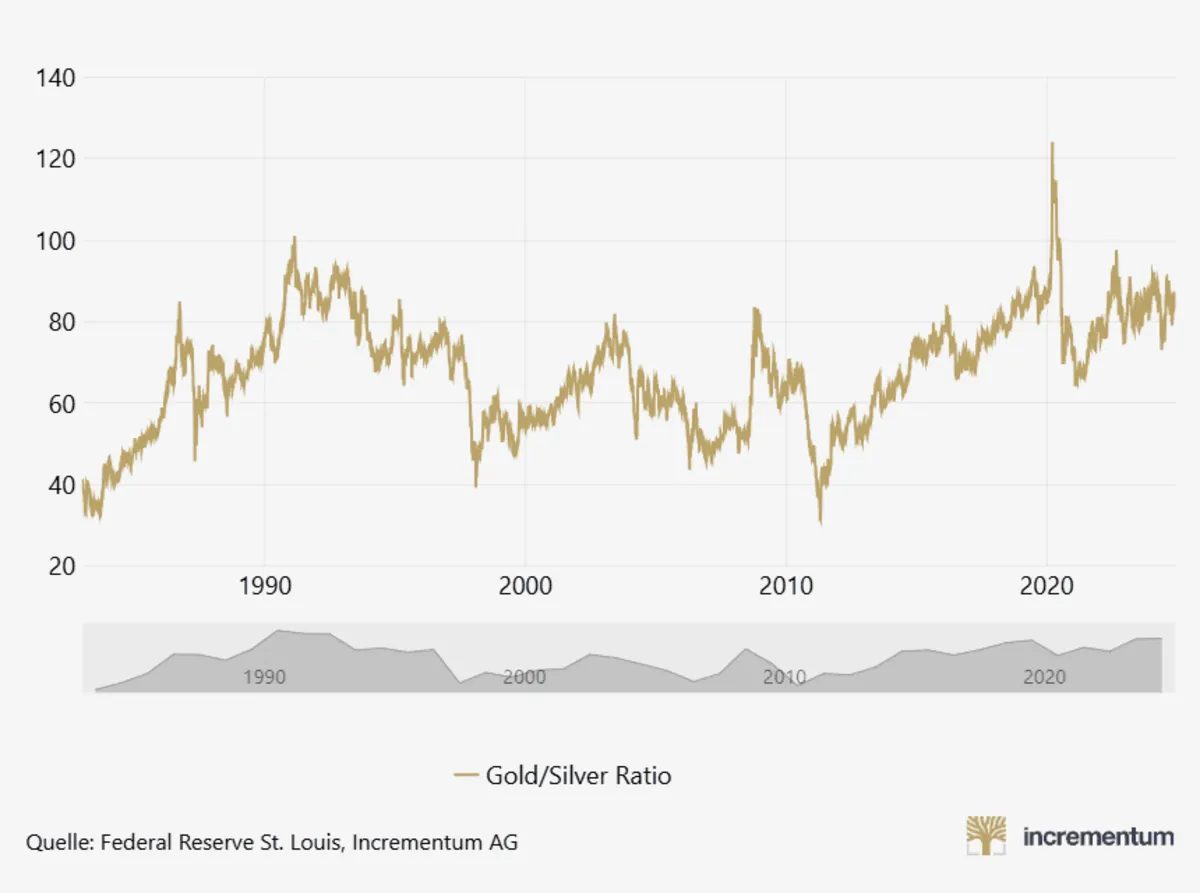

Die Silber-Gold-Ratio (Silber-Gold-Verhältnis) misst das Verhältnis des Silberpreises zum Goldpreis, also wie viele Unzen Silber für den Kauf einer Unze Gold benötigt werden. Historisch lag die Ratio bei etwa 15:1, seit einigen Jahrzehnten schwankt sie nun meist zwischen 50:1 und 100:1. Ein hoher Wert kann auf eine Unterbewertung von Silber im Vergleich zu Gold hinweisen, während ein niedriger Wert auf eine Überbewertung deutet. Investoren nutzen die Ratio, um Anlagechancen zu identifizieren und ihre Portfolios entsprechend anzupassen.

Im Vergleich zu Gold wird ein deutlich höherer Anteil des jährlich geförderten Silbers von der Industrie verwendet. Rund die Hälfte der weltweiten Silbernachfrage kommt aus der Industrie. Aufgrund der höchsten elektrischen Leitfähigkeit unter allen Metallen ist Silber ein Schlüsselfaktor der Energiewende. So hat sich die Silbernachfrage für Photovoltaikanlagen von 2020 bis 2023 nahezu verdoppelt. Auch in Elektroautos wird mehr Silber benötigt als in Fahrzeugen mit Verbrennungsmotoren. Weitere bedeutende Nachfragesegmente sind, in absteigender Reihenfolge, die Investmentnachfrage, Schmuck und Silberwaren wie Besteck.

Wie bei Gold bietet auch eine Investition in Silber die Möglichkeit zur geografischen Diversifizierung eines Portfolios. Länder mit der größten Silbernachfrage wie die USA, China, Japan, Indien und Deutschland sind ebenso weltweit verteilt wie die Länder mit der größten Silberproduktion, darunter Mexiko, China, Peru, Chile und Polen.

Die Silberförderung leidet seit Jahren unter strukturell rückläufigen Investitionen. Da es mindestens zehn Jahre dauert, bis eine neue Mine in Betrieb genommen werden kann, dürfte dies den Silberpreis langfristig stützen. Zudem wird Silber oft nur als Nebenprodukt beim Abbau anderer Metalle gewonnen. Politische Risiken wie Verstaatlichungen und Sondersteuern belasten die Silberförderung zusätzlich.

Gold has achieved cult status in every leading culture, playing an important role in the most influential religions.